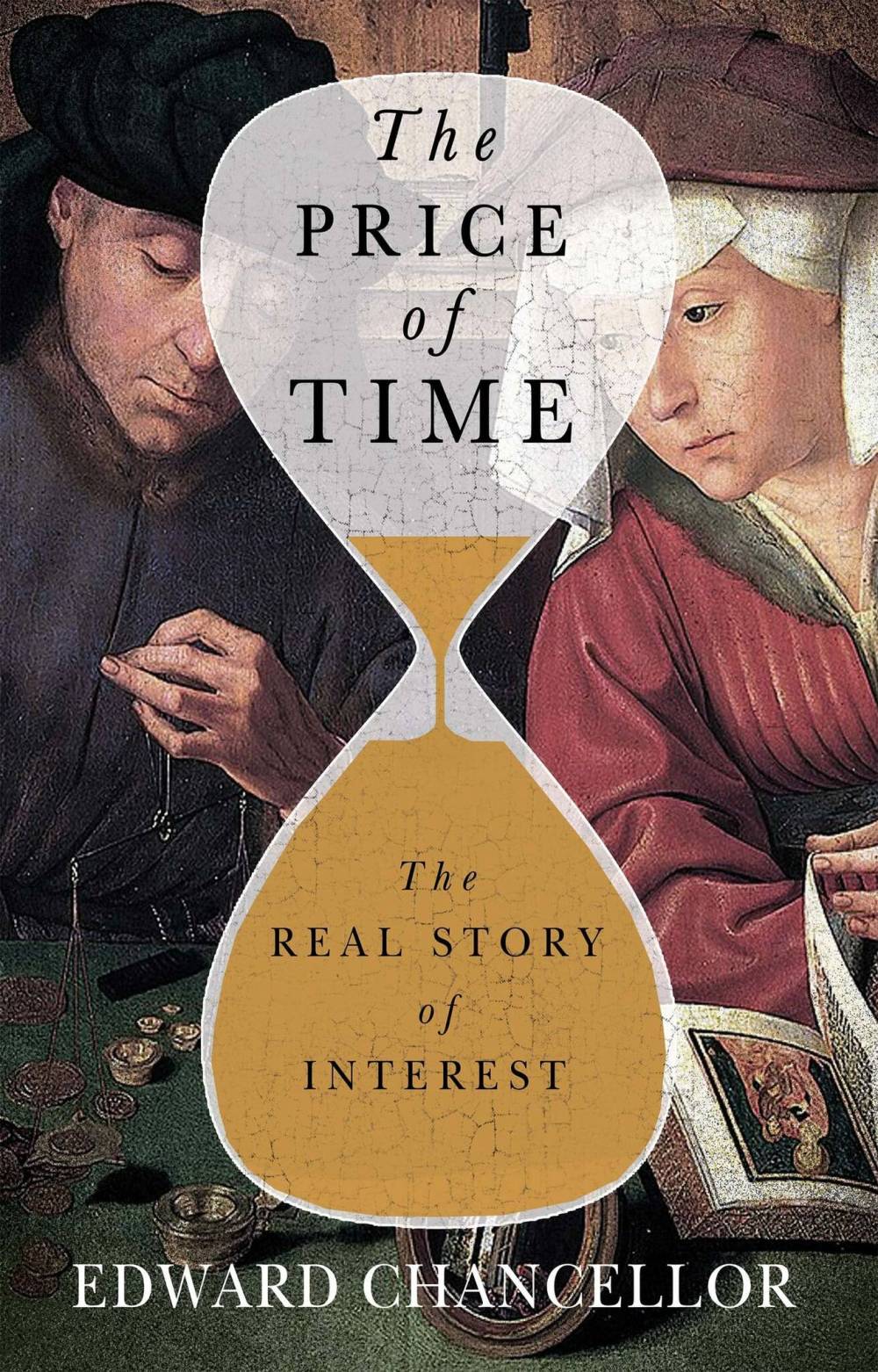

The crux of Edward Chancellor’s thesis is captured within the latter a part of his e book’s subtitle.

The accursed unfastened cash he targets is the low rates of interest central banks, together with the Financial institution of Canada, however notably the US Federal Reserve, have fostered — to the detriment of nation states and the welfare of their residents, in his view.

Chancellor is a veteran British monetary historian and journalist who’s made a profession penning realized, partaking articles and books in regards to the so-called “dismal science” of economics.

The Worth Of Time

Besides in his palms, the topic isn’t dismal in any respect. At occasions it’s downright spritely, often amusing.

He views the “ultra-low” rates of interest of current many years as contributing to a litany of main up to date financial ills — “a decline in productiveness development, asset value bubbles, rising debt ranges, insufficient financial savings and insufficient returns on financial savings, widening inequality, monetary fragility and ever-present deflationary pressures.”

He focuses on the Nice Recession of 2008-09, which noticed the failure of American funding financial institution Bear Stearns, the chapter of economic companies agency Lehman Brothers and the close to collapse of insurance coverage big AIG as a result of packaging, and tanking, of securities backed by low-interest subprime mortgages that cascaded into default. As he places it, “straightforward cash produced the growth and the growth was adopted by the inevitable bust.”

The financial collapse stemming from the low-interest charge coverage of the Federal Reserve, coupled with the U.S. greenback being the worldwide reserve foreign money, impaired the credit score methods of nations from Iceland to Australia, creating a worldwide financial disaster.

Low rates of interest are additionally the car that allows the company finance observe he labels “monetary engineering.”

What most outrages him is company share buy-backs, which enable an organization to legally re-purchase, on demand, shares beforehand issued to traders, utilizing funds the company borrowed at low rates of interest.

The result’s to extend the worth of the remaining shares, which are sometimes owned, and/or stock-optioned to be owned, by CEOs and different senior company officers. Share values and dividends are thus enhanced, with out corresponding real-world productiveness or profitability. It’s a synthetic mechanism that creates wealth for the few.

“Because of the miracle of economic engineering, the earnings-per-share of S&P 500 corporations grew sooner than reported income and gross sales,” he writes.

“Even corporations with declining income have been in a position to report an increase in per-share earnings. Some corporations, together with Exxon and IBM, operated what have been in impact Ponzi schemes by distributing extra in buybacks and dividends than they earned by means of revenue.”

The e book’s solely weak half is its first 4 chapters. Chancellor traces the use, and prohibition, of curiosity in historical civilizations on via to the Center Ages, and its ecclesiastical and authorized proscription as “usury.” He’s punctilious and complete, citing nearly each historical authority on each the morality of curiosity fees and the mechanisms to fixing acceptable charges of curiosity. His copious citations make for a gradual begin.

However as soon as warmed up, he’s a beautiful instructor and wordsmith.

For those who’ve ever puzzled how central financial institution interest-rate setting impacts the financial system and the motion of the inventory market, and your private funds, this e book’s your ticket.

Douglas J. Johnston is a Winnipeg lawyer and author.

:quality(70)/cloudfront-us-east-1.images.arcpublishing.com/tronc/Y2GFR2N2L5G7TNM6TS35ICBLYM.jpg)